97% of Mutual Funds Underperform

Ok, ok. To be fair, that stat is just for U.S. equity mutual funds. Fixed income mutual funds did much better with only 87% of investment grade corporate bond funds underperforming their own benchmark over the last 20 years... (sarcasm)

(Interested in a portfolio review for $99? Click here.)

Twice a year the S&P publishes a report called SPIVA, which is a scorecard to see how mutual funds, aka active portfolio managers, are faring versus their passive index funds. SPOILER ALERT: Active management is getting killed. The SPIVA report even controls for other variables such as style drift, survivorship bias, and avoids double counting different share classes of the same fund. This makes SPIVA the most accurate and reliable performance data available in the Active vs. Passive debate.

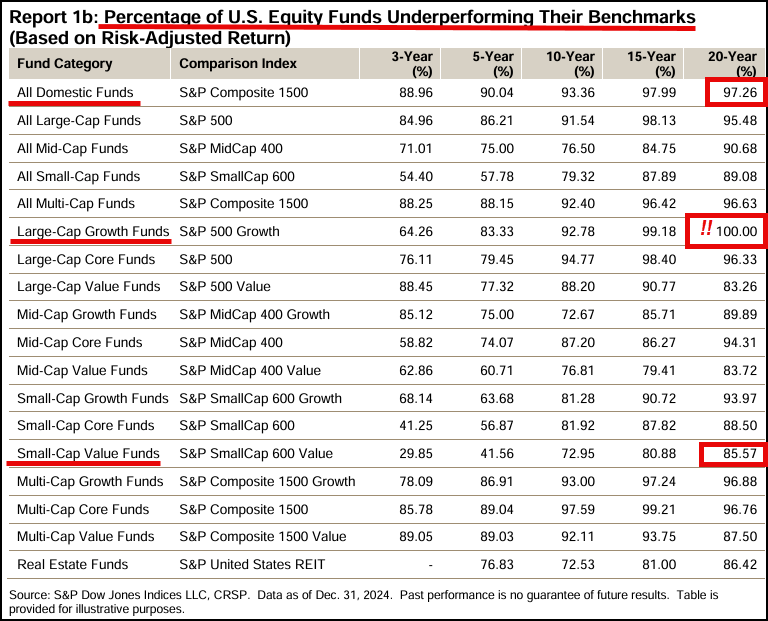

Let us take a closer look at the active stock pickers performance in their mutual funds over the last 20 years:

97% of all U.S. stock funds underperformed the S&P Composite 1500 index.

100% of large-cap growth equity funds underperformed their index. (In other words, not a single portfolio manager in this sector beat their own benchmark)

85% of small-cap value funds, a favorite sector of mine for its diversification benefits, failed to outperform the passive index for their market.

SPIVA Report 2024 U.S. Equities

Fixed income returns are only slightly better for active managers:

87% of corporate bond funds failed to beat the U.S. Aggregate Index on a risk-adjusted basis over the past 20 years.

100% of emerging market bond funds failed to beat the performance of their sector benchmark.

85% of muni bond funds and 100% of bank loan funds failed to beat their own benchmarks over the last 15 years.

SPIVA Report 2024 Fixed Income

There is no reason to be paying Wall St. mutual fund managers anymore. We have enough data (20 years) to see that the exorbitant fees that they charge are just a transfer of wealth, from your pocket to theirs.

If you are working with a financial advisor that is "picking the best mutual funds," be sure to ask them why they picked the funds you own. There is a 97% chance that you would have been better off buying the S&P 500.

Here at Axis Capital we invest in broad based index funds with low fees. The resulting effect is that you keep more of your money invested instead of paying it out in fees. This has a tremendous impact on your wealth when compounded over a 20 year period.

If you would like to discuss portfolio management further, click Book A Meeting.